Free IMANET CMA-Strategic-Financial-Management Exam Questions

Become IMANET Certified with updated CMA-Strategic-Financial-Management exam questions and correct answers

Southwest Supplies Inc. (SSI) is considering the following two projects with cash-flows discounted at SSI's

weighted average cost of capital.

SSI can only afford to invest in one of the projects. Which statement would most likely explain why SSI

would choose Project B over project A?

SSI can only afford to invest in one of the projects. Which statement would most likely explain why SSI

would choose Project B over project A? Which one or the following costs Is a variable product cost?

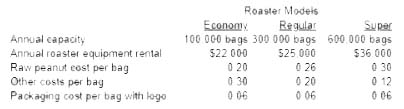

L&H Sports owns and operates several stadiums used for baseball and soccer games Management is considering installing machines that would be used to roast peanuts on the premises. This equipment would allow L&H to sell freshly roasted peanuts rather than the pre-roasted peanuts that are currently sold Marketing studies suggest that this feature would increase peanut sales. The roasters can be purchased in several sizes, and the annual rental fees and operating costs vary with the size of the roaster Information about the roasters is shown below.

Below is the income statement and balance sheet for a retail corporation.

Slam-Dunk Shoes has 5,000 pairs or damaged shoes in inventory. The cost of these shoes was $51,000. in their present condition, the shoes may be sold at clearance prices for $29,000 Slam-Dunk can have the shoes repaired at a cost of $77,000 after which they can be sold for $100,000. What is the opportunity cost of selling the shoes in their present damaged condition?

© Copyrights DumpsCertify 2026. All Rights Reserved

We use cookies to ensure your best experience. So we hope you are happy to receive all cookies on the DumpsCertify.